The Flame Detector Market: A Critical Growth Driver for Industrial Automation and Safety

The flame detector market is entering a phase of robust and critical expansion, directly correlating with the global push for advanced industrial automation and stringent safety protocols in hazardous environments. Originally valued at $1.95 billion in 2024, the market’s value is projected to surge to an estimated $3.5 billion by 2035, maintaining an impressive Compound Annual Growth Rate (CAGR) of approximately 5.4% over the forecast period (2025–2035). This consistent growth is primarily fueled by mandatory real-time safety regulations, accelerating industrialization, and the integration of highly sensitive detection technologies with larger control systems like PLC and DCS.

Market Dynamics: Regulation and Automation Drive Demand

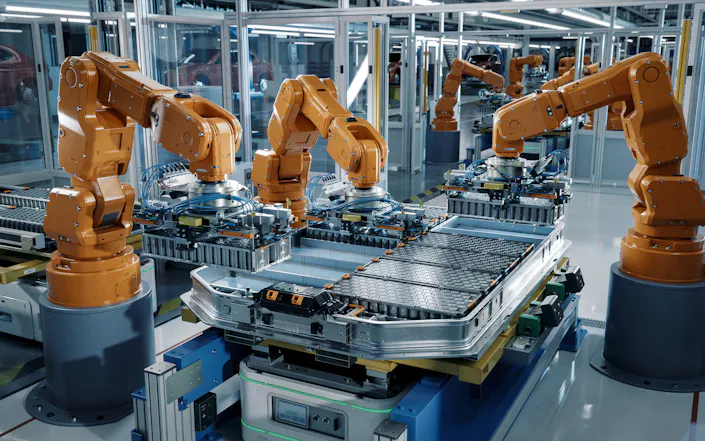

The fundamental driver for flame detector adoption remains the unyielding regulatory framework across high-risk sectors, notably in chemical processing, oil and gas, and advanced manufacturing. Industries are not just meeting compliance; they are proactively investing in sophisticated systems to prevent catastrophic incidents and minimize operational downtime. The shift towards comprehensive factory automation means safety systems are moving from standalone units to integrated components of the main industrial automation network. Moreover, innovations in multi-spectrum optical sensors significantly boost detection accuracy, effectively reducing false alarms—a crucial factor for reliable system performance.

Technological Innovations in High-Fidelity Detection

The market is currently seeing a rapid evolution in sensor technology. Modern flame detectors employ various advanced methods, including Ultraviolet (UV) detection, Infrared (IR) detection, and highly complex UV/IR and Multispectrum Optical configurations. These cutting-edge solutions offer enhanced sensitivity and much faster response times compared to older thermal or smoke-based systems. For instance, Multispectrum IR detectors analyze multiple specific IR wavelength bands, a technique that allows them to distinguish genuine flames from interfering heat sources, significantly improving reliability. This high-fidelity detection capability is non-negotiable for critical infrastructure like refineries and power generation facilities.

Key Market Expansion Catalysts

Several factors are collectively pushing market boundaries:

Stringent Safety Mandates: Increased enforcement of safety laws globally, particularly in explosion-prone environments.

Adoption of Automated Suppression: Growing demand for integrated systems that link a flame detection event to an immediate, automated suppression response.

IoT Integration: Rising investments in Smart Industrial Safety Systems that utilize IoT-enabled detectors for remote monitoring and predictive maintenance.

Emerging Market Infrastructure: Rapid expansion of petrochemical and energy infrastructure in the Asia-Pacific and Middle East regions.

System Synergy: The seamless integration of detection units with existing building management and industrial automation systems, optimizing control room operations.

Author’s Insight – Powergear X Automation

As an industry expert, I see the future of flame detection less as a device and more as a crucial input node for the main control loop. Integrating these detectors directly into the DCS or PLC is no longer a luxury but a standard expectation for modern, resilient control systems. Companies that master low-latency communication between their detectors and the central safety shutdown system will dominate the next decade.

Navigating Challenges in Deployment

Despite the positive outlook, the industry faces notable hurdles. The initial capital expenditure for advanced, multi-spectrum systems can restrict adoption among smaller industrial players. Furthermore, proper installation and complex calibration—especially in dusty, high-vibration environments—demand highly skilled technicians. Manufacturers must also continuously address the challenge of false alarms. While technology improves accuracy, operational reliability still requires overcoming environmental interference, which can be mitigated through innovative signal processing and filtering algorithms.

Competitive and Regional Landscape Analysis

The competitive environment is characterized by a strong focus on technological differentiation and adherence to strict international safety standards (e.g., FM, ATEX, IECEx). Leading players like Honeywell, Emerson, and Siemens are investing heavily in wireless and remote diagnostics capabilities. The regional growth dynamics show clear patterns:

North America: Holds market leadership due to robust oil and gas operations and a proactive stance on regulatory compliance.

Europe: Exhibits steady growth, driven by mature industrial automation sectors and continuous modernization of facilities.

Asia-Pacific: Poised for the fastest growth, fueled by massive investments in new industrial and energy infrastructure.

Core Technology Focus Areas

Modern flame detection systems are defined by key technical features:

✅ Multi-spectrum sensor fusion for enhanced accuracy.

⚙️ Wireless and remote diagnostic capabilities for reduced wiring costs.

🔧 Integration with predictive maintenance platforms and AI-driven safety analytics.

✅ Miniaturized form factors suitable for confined or specialized applications.

Future Outlook: The Role of AI in Flame Detection

The market’s trajectory points towards greater intelligence and interconnectivity. The next wave of innovation will involve machine learning and Artificial Intelligence (AI) to interpret complex sensor data, significantly reducing false alarm rates and enabling predictive maintenance. This means a detector will not just report a flame, but potentially predict the likelihood of one, based on analyzing ambient conditions and system anomalies. This move from reactive to truly predictive safety is where the significant value will be unlocked for end-users seeking maximal operational uptime.

Application Case Study: Offshore Platform Safety

Scenario: A critical offshore drilling platform required upgrading its entire safety system to meet stringent international standards for fire and gas (F&G) detection.

Solution: The company deployed a network of UV/IR and Multispectrum Optical Flame Detectors, directly integrated into the platform’s primary DCS (Distributed Control System).

Outcome: The system utilizes the DCS to manage detection alarms, initiate automated deluge systems, and trigger emergency shutdown (ESD) sequences with millisecond precision. The integration ensured complete visibility of F&G status on the main control panel, improving operator response time and significantly enhancing the platform’s overall risk profile.

Frequently Asked Questions (FAQ)

Q1: How does integrating flame detectors into a PLC or DCS improve system reliability?

A: Direct integration allows safety events (flame detected) to be handled immediately by the main control systems without reliance on slower, proprietary communication layers. This ensures faster response times, centralized fault diagnostics, and facilitates rapid, coordinated shutdown or suppression actions, which is essential experience for high-risk environments.

Q2: What is the main challenge when choosing between UV and Multispectrum IR detectors for a new facility?

A: The main challenge is balancing cost against the operating environment. UV detectors are fast and cost-effective but are prone to false alarms from welding, lightning, or certain process lights. Multispectrum IR detectors are more expensive but offer superior false alarm immunity and better detection range. I recommend a risk assessment based on the unique interference sources of your specific facility before making a final decision.

Q3: Besides initial cost, what is a key operational expense for advanced flame detection systems?

A: Beyond initial cost, the key operational expense relates to calibration and maintenance. Advanced detectors, particularly multi-spectrum types, require periodic, specialized calibration using certified test lamps. This demands skilled personnel, and maintenance planning must account for these scheduled service windows to ensure the detectors maintain their required sensitivity and compliance standards.

Are you looking to upgrade your industrial safety systems or integrate advanced flame detection into your existing control systems?

Click here to visit Powergear X Automation for cutting-edge industrial solutions and expert consulting: https://www.powergearx.com/